Equity crowdfunding – A great way to invest?

Crowdfunding has become a very common theme in investing circles. Yet aside from the obvious of investing as part of a crowd, investors know very little about how this rapidly growing market works. In this article, we lift the lid on this important investment sector to explain how crowdfunding works from both an investor’s and company’s perspective.

We hope by the time you have finished reading this article you will know more about this market and be better equipped to decide whether this investment class is for you.

Crowdfunding also includes raising money for charities and good causes such as Jonny who would like a second-hand bike as his parents are not in a position to provide it, so a GoFundMe page has been set up to help out.

How big is crowdfunding?

Wikipedia cited that over US$34 billion were raised worldwide by crowdfunding in 2015. However, in reality, it is very difficult to know the true value of this number, due to a huge number of small-scale projects that often involve a charitable cause. The crowdfunding market is projected to grow to $300 billion by 2030.

Looking at the numbers from an investment perspective, we can see that crowdfunding is becoming an increasingly popular way for companies to raise and for investors to invest.

In the U.S. in 2020, $17.2 billion was generated from crowdfunding alone. This represented a rise of 33% compared to the previous year. Statista projects a compound annual growth rate of 14.7% for the next four years.

In the UK crowdfunding is not as common as in the U.S. but is catching up pretty fast. Statista states that, “The total annual volume of equity based crowdfunding in the United Kingdom (UK) grew from under 30 million British pounds in 2013 to almost 550 million British pounds in 2020.”

What is equity crowdfunding?

Equity crowdfunding simply relates to crowdfunding which is done on a commercial basis where companies are raising venture capital and investors are investing for profit.

How does equity crowdfunding work?

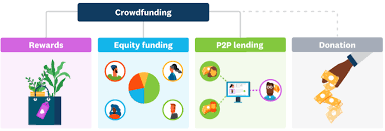

Equity crowdfunding (also known as crowd-investing) works exactly the same way as all other crowdfunding. Each project relies on several people to raise the funds for the project on hand. Although, within this broad definition there are several models that can be used.

Keep it all campaign

This type of raise is where the company advertises their project or company and whatever they raise they keep. The company will follow the terms which they outlined in the offering, by giving a percentage ownership of the company for each pound that the investor offers.

Companies typically raise funds via popular crowdfunding platforms or raise funds through target google ads and social media campaigns.

All or nothing

One of the most common types of crowdfunding raise is through an all-or-nothing approach. This type of raise requires the project to be fully completed, or they send all the funds back to the investor. This type of raise works best for a project where total funding is required. An example could be buying a property which is split between 10 or 20 investors. All prospective investors commit the funds on the understanding that the project gets fully funded. Evidence shows this type of model is twice as effective in raising funds compared to a keep it all campaign.

For investors to have confidence in this type of project they usually need to work with a trusted third party (i.e. a large crowdfunding platform) who will oversee the process. Examples of successful platforms include CrowdCube and Seedrs.

However, with the emergence of smart contracts, this will change as companies can offer the investor complete security without having to deal with a middleman. This will reduce fees so it will act as a win-win for the company and investor.

Real estate crowdfunding

Real estate crowdfunding is very popular and investors can buy into either an individual property or a large development where they typically get a quarterly rental income from the development. Usually these types of investment start from as little as £5,000.

This space is set to change with the advances in crypto-based investments. Tokenisation of real estate will offer investors the same options as most real estate crowdfunding options. The key difference will be the passage to entry will be a lot lower. Perhaps even more importantly the investor will have the ability to sell on their holdings (tokens) more easily. This is because the crypto tokens will be listed on an exchange where anyone can buy or sell them.

Debt crowdfunding

Debt crowdfunding is often referred to as peer-to-peer lending. This model offers investors a fixed return on their capital instead of investing to gain equity in the company. Funding Circle is a well-known name that operates in this space. Funding Circle lends money to businesses using investors’ funds. Traditionally business lending was offered exclusively by banks but crowdfunding platforms have offered companies different options for borrowing money.

Reward crowdfunding

Reward crowdfunding is giving investors rewards for investing. This type of crowdfunding has unlimited options. An example may be an artist giving signed pieces of work in return for funding.

Taxation of crowdfunding

Equity crowdfunding works very much like equities. As an investor, you are due to pay any capital gains tax above your CGT allowance. However, for equity-based crowdfunding, there are often options to gain exceptional tax advantages. This is the case if the underline investment qualifies for either the Enterprise Investment Scheme or the (Seed) SEIS scheme. As an investor, if you are not familiar with either of these schemes it is worthwhile researching them as if used correctly they can increase your investment return.