How to invest in property through a pension.

Many investors perceive property as a better investment compared to investing in equities and are unsure of whether to invest in a pension or property to fund retirement. However, there are other options. In this article, we discuss how you can invest in property through your pension to take advantage of the tax breaks that pensions provide.

Before we explain the options available we take a look at the sentiments of UK investors concerning retirement planning.

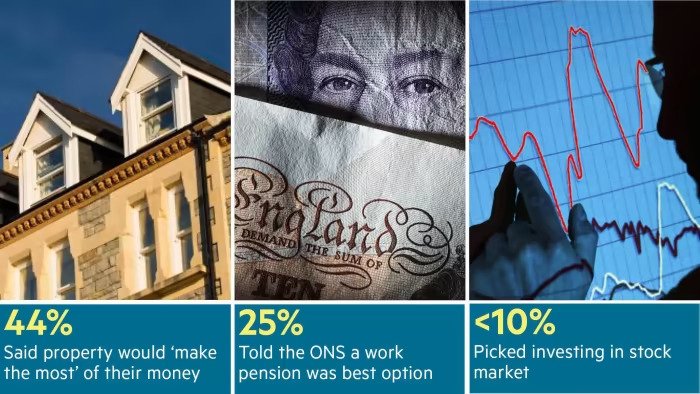

Sentiment

Back in 2015, when new pension legislation came into effect, many investors flocked to property as the perception was that this investment class would be the best choice to provide for their retirement. Official figures, from the Office of National Statistics, showed that “44 per cent said it would “make the most” of their money. Pensions from a job came a distant second at 25 per cent.

Fast forward a few years and perceptions have changed. A survey of 1,000 UK investors and 500 high-net-worth individuals by investment house Rathbones found just 7% of people have plans to increase their exposure to the property market.

Research by Aldermore Bank found that 25% of landlords think tax relief changes are the main challenge to investing in buy-to-let property, while 22% are concerned about the additional stamp duty levy.

It is thought that rising costs are more likely to “put off the 49% of landlords who have just one buy-to-let property than portfolio landlords. According to Statistica, some 27% of landlords own two or three properties, 10% own four or five, 7% between six and 10, and 6% have more than 10 properties in their portfolio.”

Robert Szechenyi, investment director at Rathbones, stated: “Recent changes to tax and regulatory treatment of buy-to-let has caused investors to take a step back and assess the viability of these investments.”

Property or pension for retirement planning

Many people look at retirement planning and debate whether they should invest in property or a pension to fund retirement. In our recent article, is property better than a pension? looked at the merits of both of these options. There are several advantages for investing in a pension and we suggest reading the article if you are not familiar with how pensions work.

The key advantage of a pension

The key advantage of a pension is the way it is taxed. By placing money into a pension you are effectively reducing the amount that you earn in the current tax year. As a result, the government will re-credit you back any additional contributions at your taxed rate. So a person who is taxed at 40% will receive 40 pence for every pound they invest. In effect, such an investor putting an extra £10,000 in a pension will receive £4,000 back so the £10,000 investment only costs them £6,000 from their net pay.

Key advantage of property investment

Many investors like property, and with good reason. They have seen property do very well for them over several years. As an asset class, it is tangible and many feel it is something they understand. This gives them confidence. Because of this, they see property as a reliable way to generate wealth.

Investing in property through a pension

For investors, there are ways where you can invest in property through a pension and enjoy the tax benefits that pensions provide. We take a look at the most common ways to achieve this.

SIPP

A self-invested personal pension (SIPP) is a type of pension that allows you to save, invest and build up a pot of money for when you retire. It is a type of personal pension and works in a similar way to a standard personal pension giving the same tax benefits. The main difference is that with a SIPP, you have more flexibility with the investments you can choose.

With a SIPP you can invest in commercial property. This includes offices, warehouses, industrial units, retail premises, surgeries, agricultural land, hotels, and pubs.

Benefits of buying property through a SIPP

There are several advantages of buying commercial property through a SIPP. We include the main ones below:

- Tax relief. When investing in a SIPP you still receive tax relief at your rate of tax so a 40% taxpayer will only be paying 60 pence net in the pound when placing money into their SIPP.

- CGT exempt. If you buy commercial property through a SIPP and later sell it for profit there is no capital gains tax to pay.

- Rental income. The rental income is not classed as a contribution and so you can still make a personal contribution equal to your earned income (subject to the annual pension allowance) and benefit from tax relief, or an employer contribution to reducing your corporation tax liability.

- Mortgageable. You can still obtain mortgage finance but borrowing is capped to 50% of the property value.

- Mixed-use property can be permitted. You can buy some commercial property that also has residential property attached. An example is a shop with a residential flat above it. But the occupant must not be the holder of a SIPP invested in it. You can find out more about what is and isn’t permitted here.

Limitations of property with a SIPP

Rules about investing in property through a SIPP are strict. We enclose the main limitations here.

- Residential property. You cannot buy residential property directly without incurring a penalty. Currently, there is a 55% tax charge.

- Liquidity. Commercial property can take a longer time to sell in comparison to other investments.

- Large investment. Buying commercial property can be a large outlay. So unless you have a large pension pot, you may struggle to remain diversified whilst using your SIPP to buy property.

- Purchase charges. The initial charges to purchase a property through a pension scheme are often higher. There are usually also additional legal fees, stamp duty charges, as well as the usual purchasing costs.

SSAS

A small self-administered scheme, or SSAS for short, is an employer occupational pension scheme that is set up by the directors of a business who want more control over the investment decisions relating to their pensions, to use it, to invest in the business.

A SSAS has similar rules to a SIP and as such they give provide the same benefits and limitations for investing in property through its structure.

Indirect investment

Many pension funds choose to invest indirectly into property using pooled vehicles. These include unit trusts, open-ended investment companies (OEICs) or real estate investment trusts (REITs).

OEICs and unit trusts

OEICs and unit trusts are very similar and are collective investment schemes. Both are open-ended which means investors can join or leave without having to find another investor on the other side of the transaction. This means the number of units in the fund can go up or down to match market demand.

When investing in these schemes you receive income in the form of dividends and long-term capital growth as the unit price goes up in value.

OEICs and unit trusts that invest specifically in property can invest in residential property. This is assuming the fund is structured for this, as some funds prefer to concentrate on commercial property only due to the higher yields.

Below we outline the key advantages of investing in property through funds. For more information on this subject, read our article on property funds. Alternatively, you can read our guide about alternative property investments, which is located in the investment hub.

Benefits of OEICs and unit trusts

- Can go into a pension. Both types of investment can go into a pension and enjoy the tax relief benefits without penalties. This includes funds that focus on residential property as well.

- Liquidity. Switching in and out of these funds is easy and there is little cost in doing so.

- Professionalism. These funds are managed by experienced investment managers who have a lot of market information at their disposal. This in theory will help them secure the right acquisitions.

- CGT exempt. They can sell a property without having to pay capital gains tax.

- Passive investment. There are none of the headaches that come with buying a property directly.

Limitations

- Not a tangible asset. Many investors like buying a property directly as they can see and feel it. With property-based funds, you don’t get this benefit.

- Less control. When investing in funds you don’t decide what assets to buy and sell, and when to execute these transactions. The fund manager does. Whilst you can select a fund based on your preferred investment criteria, you are still not the decisionmaker.

- Corporation tax. The fund will have to pay corporation tax or the companies the fund invests into will. There is a structure in place to prevent the investor from being worse off (from a tax perspective) through investing in a fund compared to managing any investment themselves. This is a complex subject and we suggest reading this article about the taxation of funds.

Real Estate Investment Trusts

Like property funds you can invest in REITs through your pension. REITs are companies which invest in real estate but distribute the majority of their income back to the investor.

REITs are close-ended. This means that there is a fixed number of shares in circulation, so in order to buy you need to find a person who is prepared to sell.

There are several advantages of REITs.

Advantages of REITs

- REITs offer all the same tax benefits as property funds. With REITs, you can get the benefits of placing the product in your pension and the associated tax relief.

- Liquidity. Like funds, REITs can be bought and sold easily via the stock exchange .

- Professionalism. REITs are managed by experts with lots of market knowledge.

- CGT Exempt. REITs are also exempt from paying capital gains tax on their disposals.

- Passive investment. Again with REITs, the investment is fully managed for you. You simply invest in the REIT which matches your investment objectives.

- No corporation tax. This is a key advantage of a REIT. Unlike other property companies, it is exempt from paying any corporation tax. This means there is more profit for the investors as there is no tax on profits.

- Leverage. REITs can do controlled borrowing. This means that its profits can be magnified.

Limitations of REITs

- Not a tangible asset. This can put off some investors

- Less control. When investing in REITs the management team decides what to buy. Whilst they have to listen to shareholders, you are not the key decisionmaker.

- Volatility. The share prices in REITs can be volatile. In the early years of saving into a pension, volatility is a benefit, it can be more dangerous for investors who are closer to retirement age as they could be forced to wait a couple of years for the REIT to rebound or be forced to sell at a loss.

Shares

Another option is to invest in shares of property companies. The favourites here are housebuilders who trade on the London Stock Exchange. These include companies such as Barratt Developments, Persimmon, Bellway and Taylor Wimpy.

Advantages of shares

- Pensionable. You can invest directly in shares through your personal pension and receive the tax benefits that pensions give. You can also buy property shares through your ISA if you wish.

- Choice. You choose what company to buy and when to sell.

- CGT exempt. Any purchase through your pension is exempt from CGT.

- Liquidity. You can buy and sell on the same day if you wish.

- Professional board.

Limitations of shares

- An intangible asset.

- Volatility. A direct share is the most volatile as there in no diversification.

- Risk. A direct share investment is riskier than a fund, as all your eggs are in the same basket.

- Corporation tax. Shares are subject to corporation tax.

Property Bonds

Property bonds are essentially lending money to a property company. You can invest in a fixed-income fund that buys corporate debt from several companies. Alternatively, you could buy the debt (bond) of one specific housebuilder.

Due to the complexity of how this product is structured, we recommend reading a recent article we wrote about property bonds. This will help you with the subject matter.

Advantages of property bonds

- Fixed income. Bonds pay a fixed coupon so you know what income you will generate.

- Safer investment. Bonds are usually structured as preferential shareholders. This means you rank above ordinary shareholders to be paid back. This makes it a safer investment.

- You know what you get back. If you hold the bond until maturity you know what capital you will get back.

- Higher income. Bonds pay a coupon and this is usually higher than a dividend payment that you would get from a share, or an equity fund.

Limitations of property bonds

- Not designed for capital growth. When you buy bonds you often get back what you paid for them as they are an income-based product. However, bonds do trade on the stock market so there is a chance of a capital gain or loss if you sell before maturity. If you buy from an exchange the bond may be trading above or below par value. If it is above par you will get back less than what you paid for it than if you hold it until maturity. Whilst the opposite is true when it trades below par.

- They are not as safe as people perceive. All investment carries risk and bonds are the same. Because of this, credit rating agencies assess a company’s ability to pay back investors. They subsequently give each company a credit score that lets you know how safe any bond is likely to be.

Free Investment Review

At Esper Wealth we focus on creating wealth for our clients and building lasting relationships. We do this by offering a better quality of service compared to our peers. Our service starts with a free investment review for all of our prospective clients.

An investment review is our chance to fully get to know you. By understanding your specific financial situation as well as your investment objectives we can help you to identify the best way for you to achieve your investment goals. We pay particular attention to your risk profile to ensure that you are fully comfortable with what we recommend.

If you would like to know more about an investment review you can download the brochure from our website.