We take a look at the SEIS scheme and explain how it differs from the Enterprise Investment Scheme for companies and investors.

The SEIS scheme stands for Seed Enterprise Investment Scheme. It is commonly referred to as seed investment. The SEIS scheme was introduced in April 2012 to give additional tax incentives for investors in start-up businesses.

The scheme is very similar to the Enterprise Investment Scheme (EIS) that has been in existence since 1994. The scheme provides excellent tax breaks to investors in the scheme. These tax breaks incentivise investors to participate in growth companies. To date over £24 billion has been raised collectively from both schemes, with over 32,000 UK companies receiving funding.

Why has the government introduced SEIS?

The Enterprise Investment Scheme has proved to be very beneficial in helping raising funds for early stage investors. However, the government has recognised that it is harder for start-ups to gain funding compared to companies with a 12 month trading history

How much can a company raise under SEIS?

As the SEIS scheme is designed for start-ups, the scheme is quite restrictive in what it can raise. The maximum any firm can raise under this scheme is £150,000. Though the chancellor has extended this limited in his mini budget in September 2022. From April 2023 the limit rises to £250,000. Any company that wishes to raise more should use the SEIS scheme first and then raise any surplus funding from the EIS scheme. This is because seed offers better tax breaks to investors, so it is in their interest to secure them the best possible deal.

How much has SEIS raised?

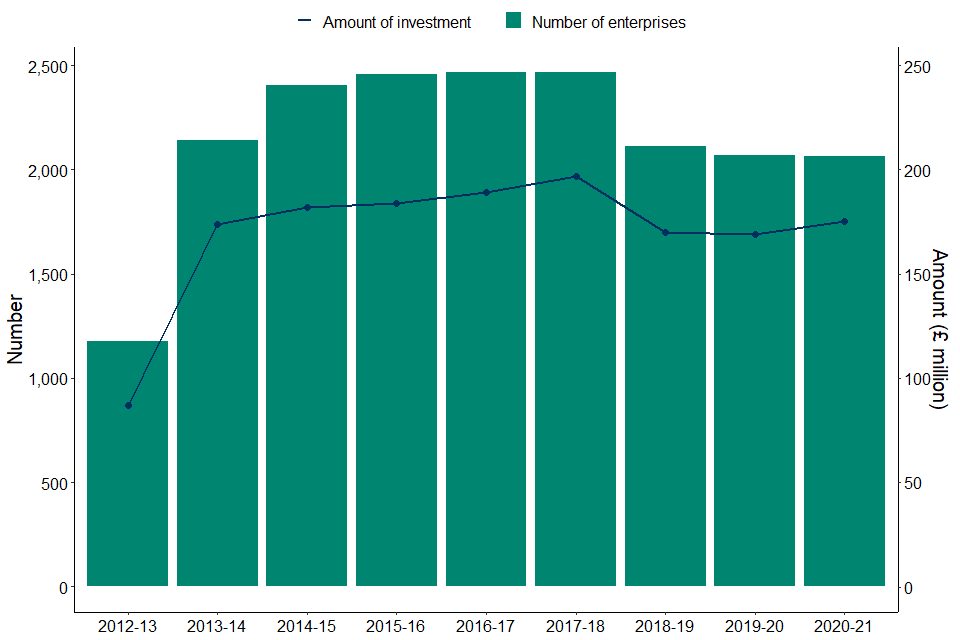

To date the SEIS scheme has raised £1.4 billion in funds for 13,800 companies. In 2020 to 2021, 2,065 companies raised a total of £175 million of funds under the SEIS scheme. Funding has slightly increased by 4% from 2019 to 2020 when 2,070 companies raised £169 million. The chart below shows the funds raised from this scheme since its inception.

What are the rules for the SEIS scheme?

From a company perspective these are the requirements of obtaining SEIS status.

- Carries out a new qualifying trade.

- Is established in the UK.

- Is not trading on a recognised stock exchange at the time of the share issue.

- Has no arrangements to become a quoted company or a subsidiary of one at the time of the share issue.

- Does not control another company unless that company is a qualifying subsidiary.

- Has not been controlled by another company since the date of your company being incorporated.

- The company and any of its subsidiaries must:

- Not have gross assets over £200,000 when the shares are issued.

- Not be a member of a partnership.

- Have less than 25 full-time equivalent employees in total when the shares are issued.

Other rules must be followed for the investor to maintain the SEIS benefits. These include:

- An investor must hold the shares for a minimum period of 3 years unless the company fails.

- An investor needs to be a UK resident throughout the duration of the investment.

- The investor has to have a risk to capital. Otherwise, it would be seen as a tax avoidance scheme.

- An investor can invest a maximum of £100,000 in an SEIS scheme. Though this increases to £200,000 from April 2023. Alternatively they can use an Advanced Subscription Agreement with a longstop of 6 months. This means investors can put in up to £200,000 in seed now and still qualify.

What are the benefits to the investor?

The tax breaks to investors are considerable. They offer the same benefit as the EIS scheme in respect to tax free growth, loss relief and inheritance tax relief. However, there are better incentives in respect to income tax relief.

Income tax relief

With an SEIS-qualifying investment an investor receives tax relief at 50%. This is much higher than the 30% offered from EIS.

CGT reinvestment relief

When you dispose of an asset and make a gain you usually pay Capital Gains Tax for the tax year in which you dispose of the asset. Reinvestment relief enables an individual who has disposed of an asset – that would give rise to a chargeable gain – to treat a maximum of 50% of the gain as exempt from Capital Gains Tax, where they have reinvested all or part of the amount of the gain in qualifying SEIS shares.

If you get SEIS Income Tax relief on an acquisition of shares, then you can claim reinvestment relief as well. You cannot get reinvestment relief unless you also get SEIS Income Tax relief. To get full reinvestment relief you must invest in qualifying SEIS shares at an amount at least equal to the chargeable gain.

SEIS in action

The table below shows a £10,000 investment in a company. There are three case examples case one is your return when the company triples in value. Case 2 is when the company breaks even and case 3 is your return if the company fails.

| Case 1 | Case 2 | Case 3 |

| The company does well and triples its value and you hold the shares for three years | The company value stays the same | The company closes and your shares are worth nothing |

| Investment = £10,000 | Investment = £10,000 | Investment = £10,000 |

| Income Tax relief = £5,000 (as a reduction in your income tax bill) | Income Tax relief = £3,000 (as a reduction in your income tax bill) | Income Tax relief = £5,000 (as a reduction in your income tax bill) |

| Share sales = £30,000 | Share sales = £10,000 | Share sales = £0 |

| Your gain = £25,000 (£20,000 profit from the sale plus £5,000 income tax relief). There is zero tax on profits. | Your gain = £5,000 (from the income tax relief) | At risk capital = £5,000 Loss relief on at risk capital @ 45% = £2,250. Your actual loss = £2,750 (£10,000 – £5,000 – £2,250) |

How do I get involved?

You can invest directly with the company that wishes to raise the funds. Alternatively, shares in the company may be offered to you from an investment firm or crowdfunding platform.

Should I invest in the SEIS?

This depends on you. If you are prepared to take some risks to achieve above average returns then this is something that you should consider. The benefits are that the majority of potential losses are offset against income tax relief and loss relief, whilst any gains are exempt from capital gains tax. This makes it very attractive for investors. The SEIS is considered by many as the UK’s best investment scheme.

However, just because an investment is SEIS-qualifying it doesn’t mean that it is a good investment. You would still need to do some due diligence first.

Important questions to ask

Below we enclose a list of questions that experienced investors ask:

- Is the company forecasting strong growth?

- Are the forecasts realistic?

- Is the company cash flow positive? Or is it pre-revenue?

- What is the cost of sales?

- What are the experiences of the directors?

- Do the directors possess financial knowledge? i.e. Do they understand cash flow, income statements, and balance sheets?

- Is the sector I’m investing in likely to perform well in the next few years?

- Does the company already have advanced assurance from HMRC?

- Do the company directors fully understand the rules to protect my tax benefits from being clawed back?

- Will the company be raising additional funds after SEIS? And if so how will any extra lines of funding affect my underlying share in the company?

Investor Profiles

Just like EIS investments, SEIS are often complex. Usually these investments are best suited to high-net-worth and sophisticated investors. So if you are inexperienced as an investor, you should speak with an accountant or an investment manager who can provide you with independent advice.

It is worth noting if you have a CGT bill to pay you can potentially acquire shares in a SEIS company at very little cost to yourself as the 50% income tax relief is added to the 50% CGT reinvestment relief. The resulting 25% left can then be offset against your rate of tax. Furthermore, any returns from the underline investment are tax free.

If you would like to know more about this scheme then contact us today.